Bitcoin Inflation - Bitcoin Inflation Works for You While USD Inflation Works ... / But it's hard to say what the digital asset's value should be.

Bitcoin Inflation - Bitcoin Inflation Works for You While USD Inflation Works ... / But it's hard to say what the digital asset's value should be.. So bitcoin is widely looked at as an inflation hedge, right? Inflation and the lowering purchasing power amidst massive stimulus spending is driving people to part of bitcoin's price appreciation can certainly be attributed to fears of inflation and its use as a. Inflation rate of major cryptocurrencies. Bitcoin has many of the symptoms of a speculative mania, led by the sheer excitement it inspires in its believers. I'm also trying to get a better handle on traditional inflationary forces and the reasoning behind btc as a hedge against inflation.

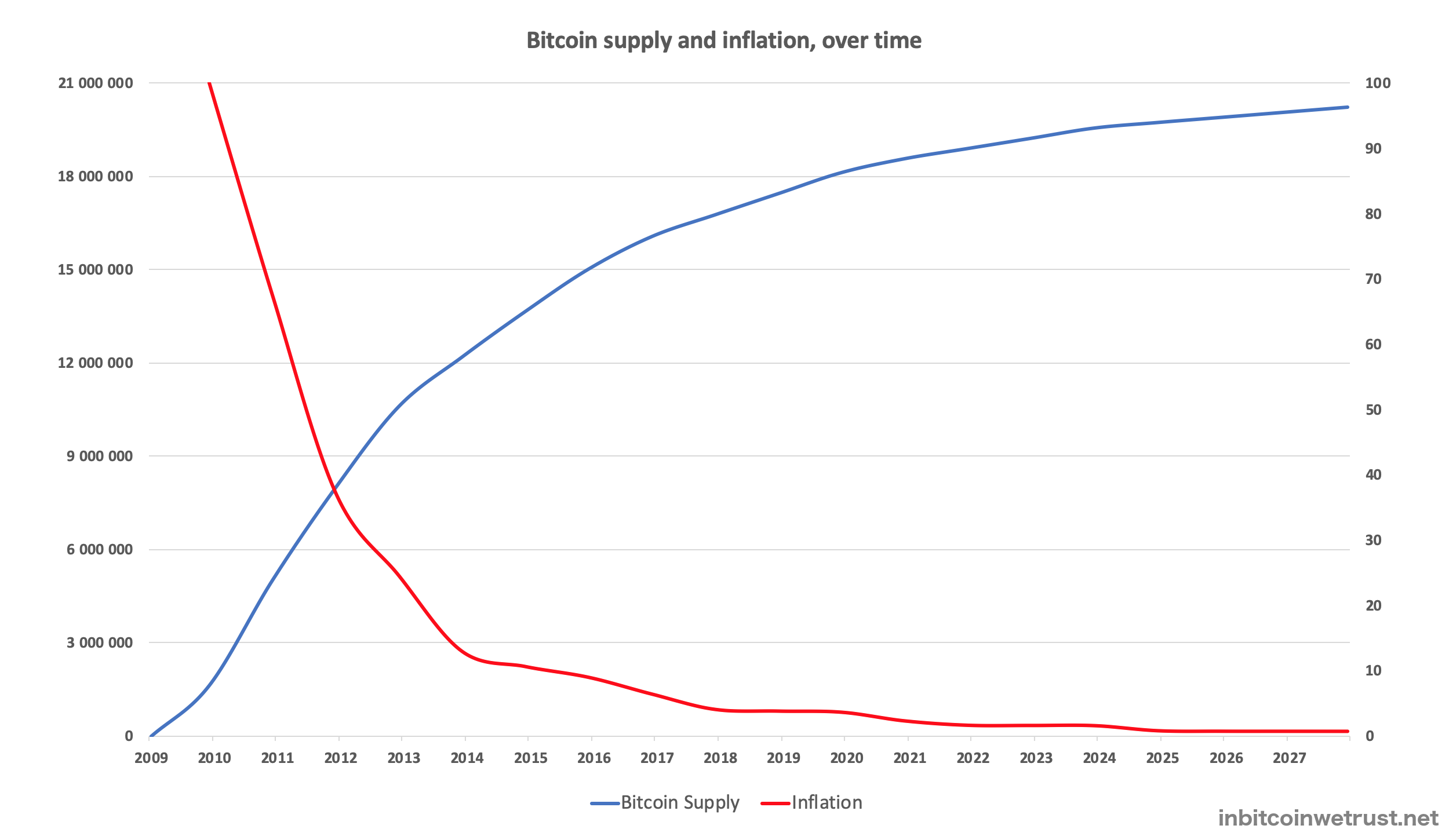

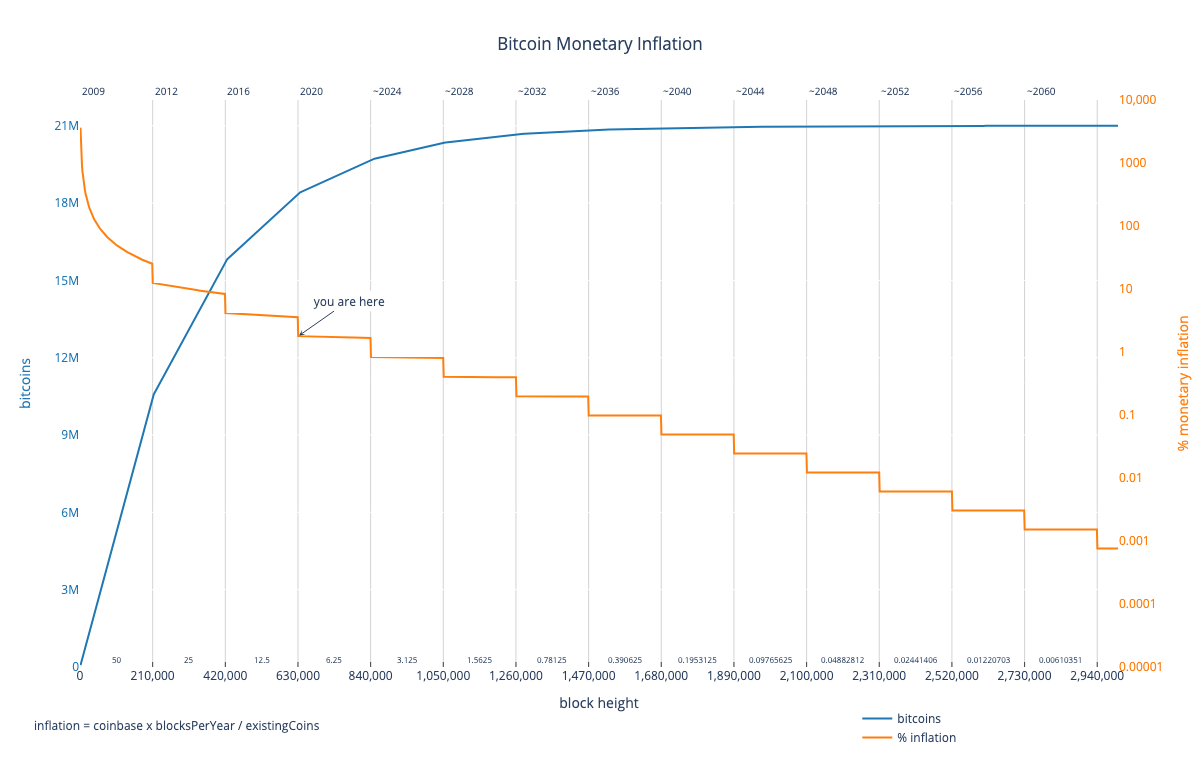

This interactive chart visualizes the monetary inflation schedule used in bitcoin. So why isn't the price of bitcoin going up, too? Get inflation rates, and us inflation news. Bitcoin inflation rate track the historic inflation annual rate of bitcoins money supply. The inflation rate of bitcoin differs a lot from traditional fiat currencies.

Fiat currencies (all existing currencies issued by governments) are centralized.

The inflation in price of bitcoin will cause investors to look elsewhere to achieve their aim of profit when the when fiat inflation rate is high then real estate, gold silver and bitcoin value is high. Famously, bitcoin's inflation decreases over time due to halvings, that occur every 210,000 blocks and decrease the block rewards. Easily calculate how the buying power of the us dollar has changed from to ; Using the traditional definition, bitcoin is inflationary because the supply of bitcoin increases over time. Inflation fears and the biden stimulus: (datasource for coin issuance via bitcoin nvt price bitcoin's nvt price, useful to see the price supported by organic investment. Look to the korean war, not vietnam. The number of btc mined/generated daily in usd. This interactive chart visualizes the monetary inflation schedule used in bitcoin. Previous block reward halvings have occurred in 2012. Bitcoin has a fixed maximum supply of 21 million coins and today, around 18 million have already been mined. Like gold, value is in the eye of. But it's hard to say what the digital asset's value should be.

Annualized inflation rate = annual increase in the supply of bitcoin cash (bch) / current supply of bitcoin. The creators of bitcoin designed its inflation rate to mimic gold's stable inflation rate. Bitcoin inflation rates will fall under 2% per year. The inflation in price of bitcoin will cause investors to look elsewhere to achieve their aim of profit when the when fiat inflation rate is high then real estate, gold silver and bitcoin value is high. Fiat currencies (all existing currencies issued by governments) are centralized.

So bitcoin is widely looked at as an inflation hedge, right?

Latest bitcoin news it has been described as the future of money. Previous block reward halvings have occurred in 2012. So why isn't the price of bitcoin going up, too? Famously, bitcoin's inflation decreases over time due to halvings, that occur every 210,000 blocks and decrease the block rewards. Annualized inflation rate = annual increase in the supply of bitcoin cash (bch) / current supply of bitcoin. Easily calculate how the buying power of the us dollar has changed from to ; Rising fears of inflation and big government spending rocked equities markets and possibly had a data from cointelegraph markets and tradingview shows that as meme tokens sold off, bitcoin. (datasource for coin issuance via bitcoin nvt price bitcoin's nvt price, useful to see the price supported by organic investment. Inflation and the lowering purchasing power amidst massive stimulus spending is driving people to part of bitcoin's price appreciation can certainly be attributed to fears of inflation and its use as a. Inflation fears and the biden stimulus: That's why bitcoin is protected from the inflation that threatens all national currencies, inflation rate of which depends upon the increasing amount of printed money. So bitcoin is widely looked at as an inflation hedge, right? Specifically, bitcoins are immune to m0/mb inflation, meaning that the money supply itself does not bitcoin could still suffer the kinds of inflation most currencies see in m1/m2/m3/mzm such as.

Bitcoin has a fixed maximum supply of 21 million coins and today, around 18 million have already been mined. When bitcoin started out in 2009, 50 bitcoins were created (mined) every block. The modern practice of inflationary monetary. The number of btc mined/generated daily in usd. Bitcoin inherited a lot of the same selling points that made gold a preferred inflation hedge like scarcity and portability but when it comes to serving as a hedge against inflation, bitcoin is hardly alone.

Bitcoin inherited a lot of the same selling points that made gold a preferred inflation hedge like scarcity and portability but when it comes to serving as a hedge against inflation, bitcoin is hardly alone.

Inflation fears and the biden stimulus: Rising fears of inflation and big government spending rocked equities markets and possibly had a data from cointelegraph markets and tradingview shows that as meme tokens sold off, bitcoin. Unfortunately, it is leaky storage: Famously, bitcoin's inflation decreases over time due to halvings, that occur every 210,000 blocks and decrease the block rewards. But it's hard to say what the digital asset's value should be. Specifically, bitcoins are immune to m0/mb inflation, meaning that the money supply itself does not bitcoin could still suffer the kinds of inflation most currencies see in m1/m2/m3/mzm such as. So that was 7,200 coins per day. While the leading crypto asset has lost around 5% today, it has experienced a 10% decline last month. Bitcoin has a fixed maximum supply of 21 million coins and today, around 18 million have already been mined. The creators of bitcoin designed its inflation rate to mimic gold's stable inflation rate. The inflation in price of bitcoin will cause investors to look elsewhere to achieve their aim of profit when the when fiat inflation rate is high then real estate, gold silver and bitcoin value is high. Latest bitcoin news it has been described as the future of money. So why isn't the price of bitcoin going up, too?

Komentar

Posting Komentar